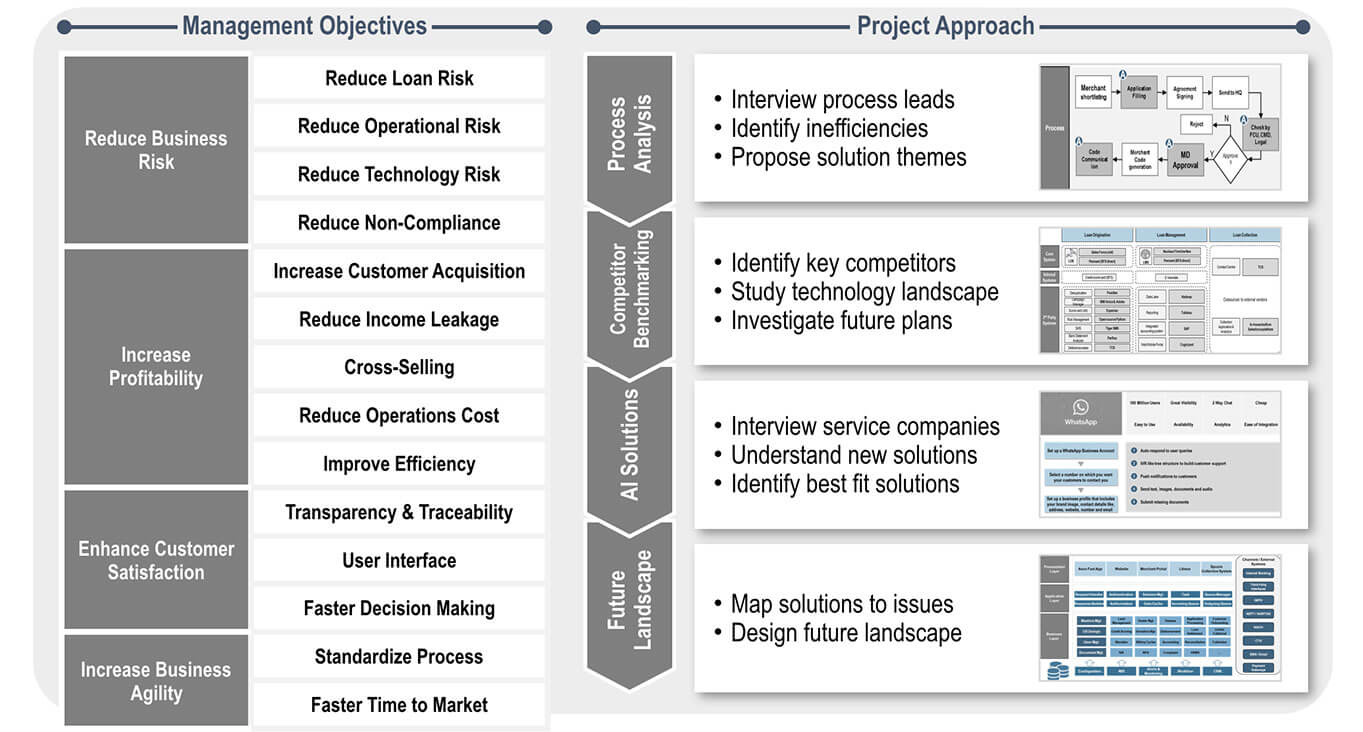

With changing business landscapes; organizations are looking to develop a robust digital roadmap to unlock the potential of the Indian consumer finance market

Holistic assessment of alternate powertrains for passenger vehicles in India

know more